Fl-aħħar sigħat Moody’s ħarġet rapport ieħor dwar Malta li fih tinnota li wara li fl-2015 l-ekonomija Maltija qabżet sewwa l-aspettativi, din is-sena xorta ser ikun hemm tkabbir qawwi ta’ madwar 4%. Xi ħaġa li tispikka ma’ pajjiżi oħra fl-Unjoni Ewropea tant li r-rapport jinnota kemm Malta hi b’saħħitha meta mqabbla mal-oħrajn.

It-tkabbir ekonomiku se jkun jirrifletti żieda oħra fid-domanda domestika u l-investiment. L-esperti ta’ Moody’s jgħidu li l-konsum privat żdied sew mill-2014.

Ir-rapport isostni preċiżament hekk: “Since 2014 private consumption has benefitted from a range of factors such as income tax cuts, lower oil prices and reduced electricity tariffs, low unemployment and associated wage increases”.

Siltiet mir-rapport Moody’s

Barra minn hekk il-Moody’s jinnutaw kemm żdied l-investiment, kemm fil-qasam tal-enerġija, fil-kostruzzjoni, kif ukoll permezz ta’ użu aħjar ta’ fondi Ewropej. L-esperti ta’ Moodys’ jinnotaw ukoll il-governanza tajba. Żewġ dikjarazzjonijiet li jispikkaw huma dawn:

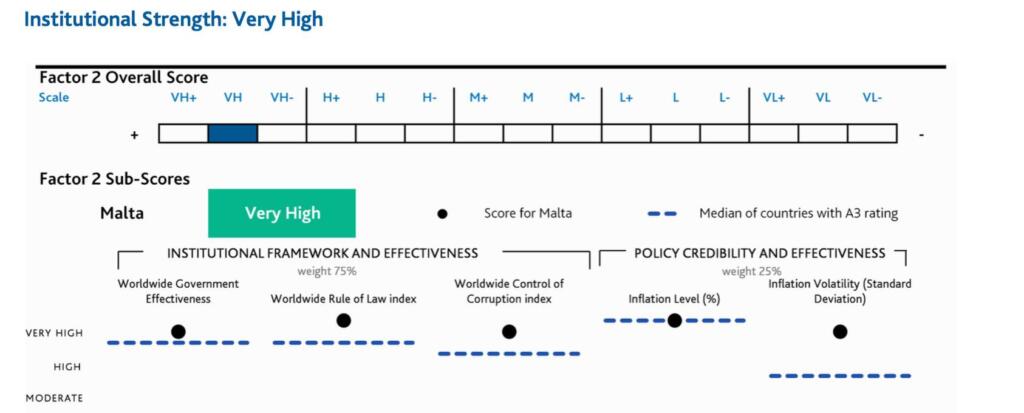

“Malta’s very high institutional strength assessment is underpinned by the country’s very favourable scores on the Worlwide Governance Indicators as well as by its robust policy framework”.

“Government effectiveness, rule of law and control of corruption… above the median for Moody’s A-rated sovereigns and significantly above its rating peers”.

Fl-istess ħin ir-rapport tal-Moody’s jinnota li grazzi tat-tnaqqis fid-defiċit fiskali, sal-2017 l-piż tad-dejn nazzjonali ser jonqos taħt is-60% tal-ġid nazzjonali, wara li kien anke laħaq 70% fl-2011.

AQRA HAWN IR-RAPPORT KOLLU

[pdf-embedder url=”http://www.one.com.mt/wp-content/uploads/2015/09/rapport.pdf”]